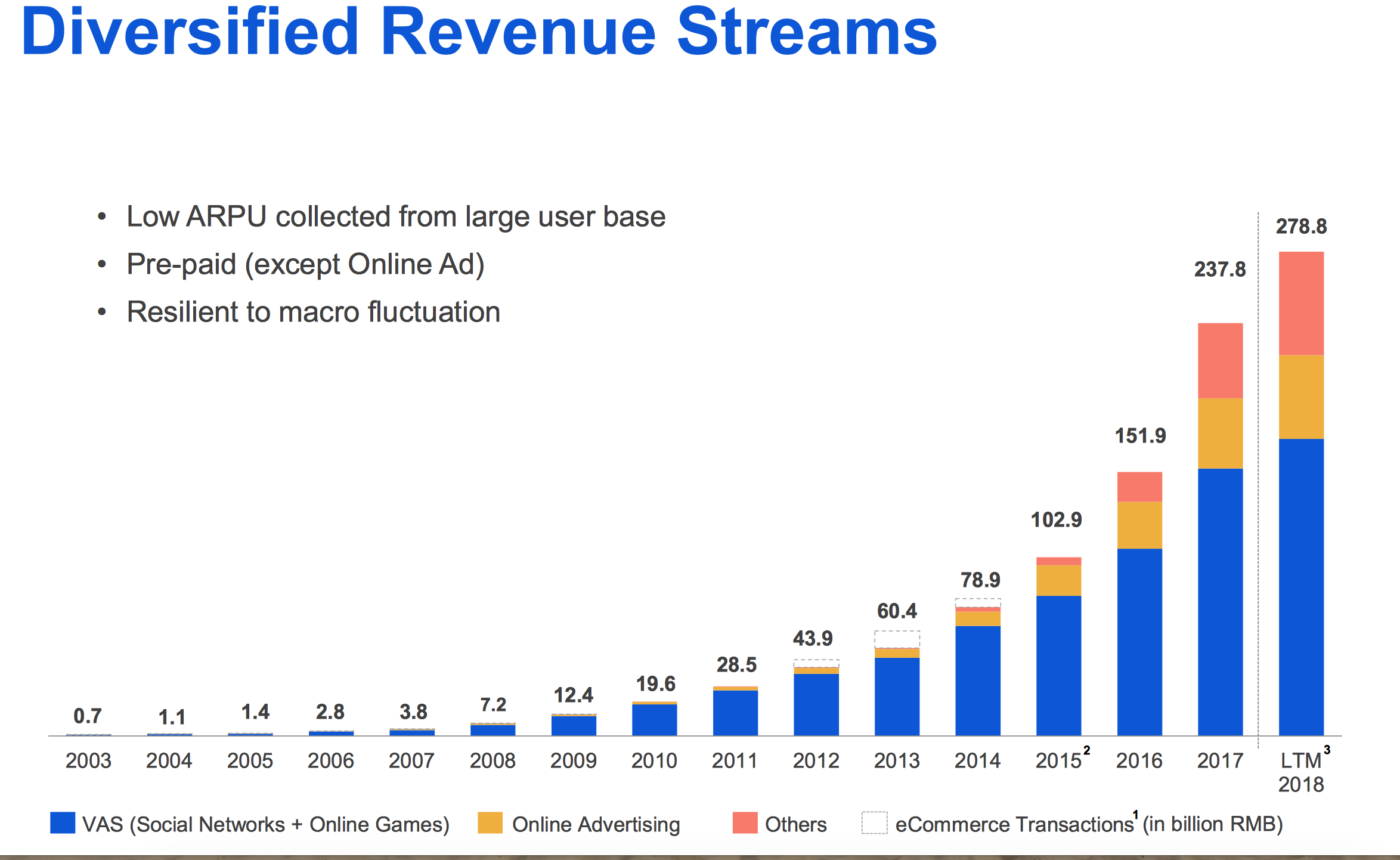

Introduction

In the ever-changing landscape of business, diversifying revenue streams is not just a strategic option; it’s a necessity for ensuring resilience and sustainability. Relying on a single source of income can leave businesses vulnerable to economic fluctuations and unexpected challenges. This article explores the importance of diversification, key strategies for implementing it, and the long-term benefits it brings to businesses.

Risks of Overreliance on a Single Source

Dependence on a single revenue stream can expose businesses to significant risks. Economic downturns, industry disruptions, or shifts in consumer behavior can have a profound impact on businesses that lack diversification, leading to financial instability and potential failure.

Enhancing Financial Resilience

Diversifying revenue streams is a proactive approach to building financial resilience. It allows businesses to adapt to changing market conditions, mitigate risks, and navigate challenges with greater flexibility. A diversified business is better equipped to weather uncertainties and maintain stability in the long run.

Expand Product or Service Offerings

Broadening the range of products or services offered allows businesses to tap into new customer segments and markets. This expansion not only increases revenue potential but also reduces reliance on a specific product or service.

Target New Customer Segments

Identify and target new customer segments that align with your business capabilities. Understanding different demographics and their needs enables businesses to diversify their customer base, reducing vulnerability to market fluctuations.

Explore Additional Sales Channels

Embrace multiple sales channels to reach a broader audience. This may include expanding online presence, exploring partnerships with retailers, or establishing a direct-to-consumer model. Diversifying sales channels provides avenues for consistent revenue generation.

Invest in E-commerce and Online Platforms

In an increasingly digital world, investing in e-commerce and online platforms is essential. Creating an online presence opens up opportunities to reach a global audience, increasing sales potential and reducing dependence on local market conditions.

Develop Subscription Models or Recurring Revenue Streams

Introduce subscription models or services with recurring revenue streams. This approach ensures a steady and predictable income, enhancing financial stability for the business.

Strategic Partnerships and Collaborations

Forge strategic partnerships with other businesses in related or complementary industries. Collaborations can lead to joint ventures, co-branded products, or shared marketing efforts, creating new revenue streams and expanding market reach.

Leverage Data and Analytics

Utilize data and analytics to identify emerging trends, customer preferences, and market opportunities. Informed decision-making based on data insights enables businesses to strategically diversify their offerings and stay ahead of industry shifts.

Explore International Markets

Diversify geographically by exploring international markets. Expanding into new regions provides access to diverse customer bases, reduces dependence on local economic conditions, and spreads risk across different markets.

Enhanced Financial Stability

Diversification contributes to financial stability by minimizing the impact of downturns in specific markets or industries. A balanced portfolio of revenue streams helps businesses withstand economic challenges.

Adaptability to Market Changes

A diversified business is more adaptable to changes in market dynamics. It can pivot quickly in response to shifting consumer preferences, technological advancements, or unforeseen events, maintaining relevance in the marketplace.

Reduced Business Risk

Overreliance on a single revenue source poses a significant risk. Diversification spreads risk across various income streams, reducing the likelihood of catastrophic financial consequences due to disruptions in a specific sector.

Increased Profitability

Diversification often leads to increased profitability. By tapping into new markets or introducing innovative products and services, businesses create opportunities for revenue growth, contributing to overall financial success.

Competitive Advantage

A diversified business gains a competitive edge. It can adapt to changes more effectively, meet evolving customer demands, and outperform competitors that are more narrowly focused in their revenue strategies.

Conduct a Comprehensive Risk Assessment

Before diversifying, conduct a comprehensive risk assessment. Identify potential risks and evaluate their impact on each revenue stream. This assessment informs strategic decisions and risk mitigation plans.

Develop a Clear Diversification Strategy

Craft a well-defined diversification strategy that aligns with your business goals. Clearly outline the objectives, target markets, and expected outcomes of each diversified revenue stream. Having a roadmap guides implementation and management.

Monitor and Evaluate Performance Metrics

Regularly monitor performance metrics for each revenue stream. Track key indicators such as sales figures, customer acquisition costs, and profitability. Continuous evaluation helps identify successful strategies and areas for improvement.

Foster a Culture of Innovation

Encourage a culture of innovation within your organization. Employees should feel empowered to propose new ideas, products, or services that contribute to revenue diversification. Innovation fosters adaptability and keeps the business dynamic.

Stay Informed About Market Trends

Stay informed about market trends, industry developments, and emerging technologies. Being proactive in identifying opportunities allows businesses to capitalize on trends and stay ahead of the competition.

Conclusion

Diversifying revenue streams is not just a risk mitigation strategy; it’s a proactive approach to building a resilient and adaptable business. By expanding product offerings, targeting new customer segments, and leveraging various sales channels, businesses can enhance their financial stability