Data Executive has prepared Russia Import Data and Russia Export Data that are critical to the country’s evolving trade patterns, economic policies, and international market visibility. For Russia, one of the world’s largest economies, those trade activities have ripple effects throughout the global markets, especially involving energy, agriculture, and industrial commodities. Russia, the implications of sanctions, and the global financial weight in the political landscape 2025 is an important year.

As it wrestles with these challenges, Russia is more deeply integrating its trade with Asia, the Middle East, and other emerging markets and striving for greater military and economic self-sufficiency. So monitoring import-export trends can help businesses, policymakers, and investors to identify opportunities and manage risks to navigate a shifting trade landscape on the ground.. Insight from Russia’s trade data enables stakeholders to make informed decisions, maintaining resilience and competitiveness in the global economy

Important Reasons Why Russia’s Import Data Is Useful for Businesses

Russia Import Data and the data it analyzes offer insights into the country’s trade dependencies, the resilience of its supply chain, and its changing economic priorities. Being aware of import trends allows businesses to shift their sourcing strategies and innovative businesses to find new market opportunities.

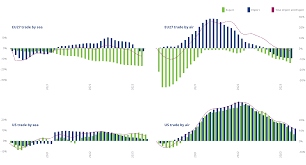

2025 Russia Imports at a Glance:

Machinery & Industrial Equipment – Required for all the infrastructure and manufacturing growth.

Pharmaceuticals & Medical Supplies ‐ Subject to increasing reliance on imported medicines and medical devices

Electronics & Consumer Goods – High volume of imports of smartphones, computers, and household machines.

Automobile Parts & Vehicles – An increase in the importation of automotive parts and electric vehicles.

Food Products & Agricultural Goods – Very stable entry of dairy, beverages, and specialty food products.

Russia Export Data: Top Sectors Driving the Economy

Russia Export Data show the dominance of the nation in energy, natural resources, and ever-growing tech exports. Russia is a major global supplier of oil, gas, and metals and is making inroads in new industries.

Top Russian Exports in 2025:

Oil & Natural Gas – Energy exports are Russia’s biggest revenue earner, intact amid geopolitical headwinds.

Metals & Minerals — Russia is the top exporter of aluminum, copper, and rare earth elements,

Wheat & Agricultural Products – Russia becomes the largest wheat exporter.

Weapons & Defense Equipment – A surge in military exports to allied nations.

Tech & IT Services – There is a Growing emphasis on software development and cybersecurity solutions..

Who Are Russia’s Biggest Trading Partners?

Russia’s trade relations have changed with global sanctions and new alliances. It has developed closer links with Asia, the Middle East, and Africa as a counterweight to curbs from Western countries.

Key destinations for Imports & Exports:

- China: Russia’s biggest trading partner, closely linked in energy and manufacturing.

- India: A major buyer of Russian oil, fertilizer, and defense equipment.

- Turkey: Food, raw and construction materials, energy.

- United Arab Emirates (UAE): Shining Market for Russian Products and Financial Investments to Grow

- Brazil: Robust agricultural trade links, especially in fertilizers and grains.

Looking Ahead: What to Expect in Russia’s Import-Export Market

Increased Attention: Logistical Supply Chains migrating over Asia & Middle East

Shifts in Supply Chains: Russia reboots factories to lower reliance on Western imports

Innovations in Global Commercial Practices: Use of blockchain and cryptocurrency for cross-border transactions

Green Energy Projects: funding renewable and sustainable industries

Dynamic Trade Policies: Ongoing shifts to circumvent sanctions and trade obstacles.

Conclusion

Russia import data & Russia export data are vital metrics to understand the country’s economic resilience, its trade dynamics, and opportunities. With the geopolitics of the new landscape, businesses and policymakers need to be ready to adapt and not get complacent and look for new routes of trade and alliances to help sustain the economy.

The new trade strategy should reflect the emerging economic realities of 2025, including an ongoing transition towards self-sufficiency and technological innovation combined with strategic cooperation with non-Western economies. As risks abound, acquiring the relevant information and understanding trade trends can help businesses to navigate uncertainty and risks and allow us to act on opportunities within the constantly shifting trade landscape of Russia.