Introduction

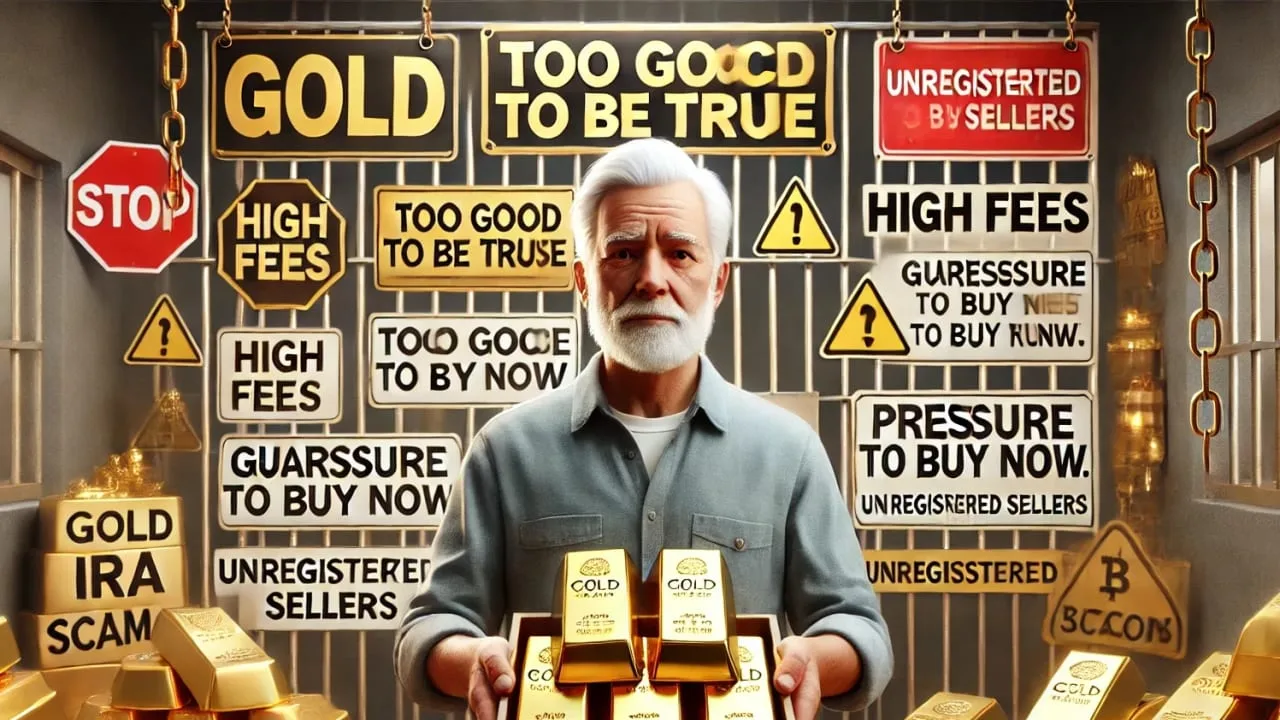

The growing popularity of precious metals IRA Scams has brought renewed interest in diversifying retirement portfolios beyond traditional stocks and bonds. Gold, silver, platinum, and palladium are increasingly viewed as hedges against inflation, currency devaluation, and geopolitical uncertainty. While these benefits are real, so too are the risks—especially when it comes to scams targeting investors unfamiliar with the rules and nuances of self-directed IRAs. Precious metals IRA scams are a growing concern, and they can result in devastating losses for those caught unaware. This article examines how these scams operate, the damage they cause, and most importantly, how to protect your savings from falling prey to fraud.

Understanding Precious Metals IRA Scams

Scammers often operate under the guise of being financial professionals or retirement planners. They target older investors with promises of safety, stability, and high returns through physical precious metals. These scammers typically use fear-driven messages, warning of a collapsing economy or unstable financial markets, to push investors into transferring their retirement funds quickly.

One of the most common tactics involves selling overpriced or ineligible precious metals—particularly collectible or numismatic coins. These coins are often marketed as rare or high-value, but they are not approved by the IRS for inclusion in IRAs. When placed in a retirement account, they not only violate IRS rules but also leave the investor with assets worth far less than what was paid.

Some scams focus on storage misinformation. The IRS requires that precious metals held in an IRA be stored in an approved depository managed by a qualified custodian. Scammers sometimes tell investors they can store their metals at home or in a personal safe, which not only violates IRS rules but could trigger taxes, penalties, and disqualification of the entire IRA.

Others hide fees in the fine print—charging excessive commissions, storage costs, or administrative fees that drastically reduce the value of the investment. In some cases, fraudsters simply take the money and never purchase any precious metals at all, disappearing before the investor realizes the scheme.

Why Investors Are Vulnerable

Precious metals are seen as a safe haven in uncertain times. This perception makes them a perfect tool for scammers looking to exploit fear. Retirees, in particular, may be more susceptible due to concerns over economic stability and limited time to recover from investment losses.

Many of these scams rely on emotional manipulation. They present gold and silver as the only “real” assets in a world of failing fiat currency, encouraging investors to act quickly to avoid disaster. Scammers often claim to be experts in retirement planning, using fabricated credentials, fake client testimonials, and high-pressure sales tactics to gain trust and expedite transactions.

These fraudulent operators may even use seemingly credible websites and advertisements to appear legitimate. They present glossy brochures, offer free investment guides, and claim affiliations with reputable financial institutions—all part of a calculated effort to lure victims.

Consequences of Precious Metals IRA Fraud

The financial impact of falling for a scam is significant. Retirement savings built over decades can be wiped out in a single transaction. When ineligible or overpriced metals are used in the IRA, the IRS can disqualify the account, triggering unexpected tax liabilities, penalties, and fees.

In addition to the monetary losses, victims often suffer emotional trauma. Feelings of shame, betrayal, and helplessness are common. Many are hesitant to report what happened out of embarrassment, which only allows these schemes to continue unchecked.

Regaining lost savings is incredibly difficult, especially for older individuals with limited time and resources. Legal recourse is often minimal because many scammers operate through shell companies or overseas entities, making them hard to trace or prosecute.

How to Spot and Avoid Precious Metals IRA Scams

Investors can significantly reduce their risk by taking a few key precautions. First and foremost, they should educate themselves about what the IRS allows in a precious metals IRA. Only certain gold, silver, platinum, and palladium coins and bars meet IRS purity requirements and are eligible for inclusion.

Research is crucial. Investors should thoroughly vet any company they are considering. This includes checking for licenses, certifications, and a solid track record. Reputable companies will be transparent about their fees, the products they offer, and the custodians they work with. Verify their reputation with the Better Business Bureau, FINRA, or other regulatory bodies.

Avoid high-pressure sales tactics. No legitimate investment opportunity requires an immediate decision. Take your time to review documents, ask questions, and seek independent advice from a financial advisor or attorney who is not affiliated with the company making the offer.

Ask for full disclosure. Get everything in writing—including fees, commissions, and details about the metals being purchased. Understand the storage arrangements and confirm that they are in compliance with IRS regulations.

Trust your instincts. If an offer seems too good to be true or the person you’re dealing with is overly persistent, it’s wise to walk away. Scammers count on you ignoring your gut.

Conclusion

Precious metals IRAs offer real advantages when handled correctly, including protection from inflation and market volatility. However, the same features that make these accounts attractive also make them vulnerable to fraud. Scammers use fear, confusion, and deception to lure in investors—especially those nearing or in retirement.

To safeguard your future, you must approach these investments with caution and a well-informed mindset. Know the rules, ask the right questions, and only work with companies that have earned your trust through transparency and accountability. With the right precautions, you can enjoy the benefits of precious metals investing without falling victim to the costly and painful consequences of fraud.