Halal investing is a way for Muslims and others to invest their money while following Islamic principles. This approach helps people make money in a way that aligns with their values, focusing on ethical practices and avoiding industries that are harmful or not allowed in Islam. In this article, we will explore the principles of halal investing, the types of investments available, and how to get started with this modern approach to building wealth.

Key Takeaways

- Halal investing follows Islamic rules and focuses on ethical practices.

- Investors should carefully check if their investments are halal and avoid harmful industries.

- There are various types of halal investments, including stocks, real estate, and bonds.

- Halal investing encourages a long-term view rather than quick profits.

- Incorporating zakat into investments helps support the community and fulfill a religious duty.

Understanding Halal Investment Principles

When you think about halal investment, it’s important to know what halal investing really means. At its core, halal investing is all about following Islamic principles while making your money work for you. This means you’re not just looking to make a quick buck; you’re also considering the impact of your investments on society and the environment.

The Role of Shariah Law in Investing

Shariah law plays a big role in halal investing. It sets the rules for what is considered acceptable. For example, you can’t invest in businesses that deal with alcohol, gambling, or anything that harms people. Instead, you focus on companies that promote good values and contribute positively to society. This approach not only helps you build a halal portfolio but also aligns your investments with your personal beliefs.

Ethical Considerations in Halal Investing

Ethical banking is a key part of halal investing. It’s not just about making money; it’s about making sure your money is used for good. You want to invest in companies that treat their employees well, care for the environment, and contribute to their communities. This way, your investments can help create a better world while also growing your wealth.

Common Misconceptions About Halal Investments

Many people think that halal investments are only for Muslims, but that’s not true! Anyone can invest in halal options. Some might also believe that halal investing limits your choices, but in reality, there are plenty of opportunities out there. By understanding the principles of halal investing, you can find ways to grow your wealth while staying true to your values.

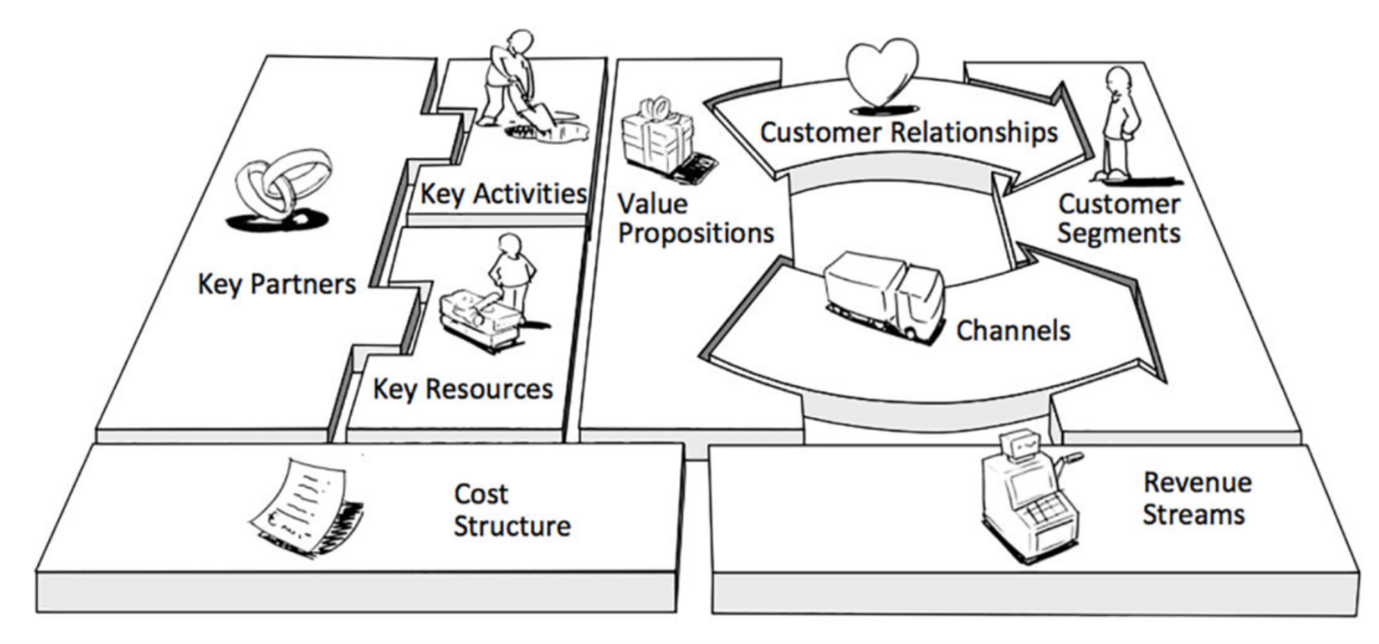

Types of Halal Investments Available Today

When you think about halal investing, you might picture a narrow path with limited options. But guess what? There’s a whole world of opportunities out there! Let’s dive into some of the main types of halal investments you can explore today.

Stocks and Equities

Investing in Shariah-compliant stocks is a popular choice. When you buy stocks, you’re essentially buying a piece of a company. If the company does well, so do you! Just make sure the company’s business practices align with Islamic principles. Avoid companies involved in gambling, alcohol, or anything that goes against your values.

Real Estate Investments

Real estate is another fantastic option. It’s a tangible asset that usually increases in value over time. You can invest in properties directly or through real estate investment trusts (REITs). Just remember to steer clear of any investments that involve interest-based loans. There are plenty of Islamic financial institutions that offer interest-free mortgages, making it easier to get started.

Halal Bonds and Sukuk

Now, let’s talk about sukuk, which are like Islamic bonds. Instead of earning interest, sukuk allows you to earn profits from a business venture. This makes them halal! They’re structured to comply with Shariah law, so you can invest with peace of mind. Just like with stocks and real estate, always check that the underlying assets are ethical and compliant.

So, whether you’re eyeing stocks, real estate, or sukuk, halal investing offers a variety of options to help you grow your wealth while staying true to your values. Happy investing!

Evaluating Halal Investment Opportunities

Screening for Shariah Compliance

When you’re diving into halal investing, the first thing you want to do is make sure your investments are in line with Shariah law. This means checking if the company’s activities are halal. Think about it like this: if a company is involved in things like alcohol, gambling, or interest-based banking, it’s a no-go. You want to focus on businesses that promote ethical practices. So, ask yourself: what does this company do? Is it ethical? If it feels right, it probably is!

Assessing Financial Health and Stability

Next up, you’ll want to look at the financial health of the investment. This is like checking the pulse of your potential investment. Look for companies that are stable and have a good track record. You can do this by checking their financial statements and seeing how they perform over time. If they’re growing and making profits, that’s a good sign! Remember, you’re not just investing your money; you’re investing in a future.

Understanding Market Trends

Finally, keep an eye on market trends. This is where you can get a feel for what’s hot and what’s not. Are there new opportunities popping up in Islamic investment banking or halal crowdfunding? Maybe you’re interested in halal real estate investment. Whatever it is, understanding the market can help you make informed decisions. Stay curious and keep learning about what’s happening in the world of halal investments!

The Benefits and Challenges of Halal Investing

When you dive into halal investing, you’ll find it comes with its own set of perks and hurdles. Let’s break it down together!

Long-term Financial Security

One of the coolest things about halal investing is that it encourages a long-term view. Instead of chasing quick profits, you focus on building wealth over time. This means you’re less likely to make rash decisions based on market hype. You’re in it for the long haul, which can lead to more stable financial growth. Plus, since halal investing often emphasizes low debt, you can feel good knowing you’re not over-leveraging yourself.

Ethical Wealth Generation

Halal investing isn’t just about making money; it’s about doing it the right way. You’re investing in businesses that align with your values, which can be super rewarding. It’s like putting your money where your heart is! You’re supporting companies that promote fairness and social good, which can make you feel proud of your financial choices.

Navigating Limited Investment Options

However, it’s not all sunshine and rainbows. One of the biggest challenges is that your investment choices can be pretty limited. Since you have to stick to what’s halal, you might miss out on some great opportunities in sectors that don’t align with Islamic finance principles. This can be frustrating, especially when you see others making big gains in those areas. But remember, the goal is to stay true to your values, even if it means being a bit more selective.

In the end, halal investing is about finding that balance between making money and staying true to your beliefs. It’s a journey, and like any journey, it has its ups and downs. But with the right mindset, you can navigate the challenges and enjoy the benefits!

How to Get Started with Halal Investing

Choosing the Right Investment Platform

Getting into halal investing can feel a bit overwhelming at first, but it doesn’t have to be! The first step is to find an investment platform that aligns with your values. Look for platforms that specifically offer halal options. You want to make sure they screen their investments for Shariah compliance. It’s like finding a good friend who shares your interests; you want to feel comfortable and supported.

Building a Diversified Portfolio

Once you’ve picked a platform, it’s time to think about your portfolio. A diversified portfolio means spreading your investments across different types of assets. This helps reduce risk. Think of it like not putting all your eggs in one basket. You might want to include stocks, real estate, and maybe even halal bonds. This way, if one area doesn’t do well, you have others to fall back on.

Consulting with Financial Advisors

Don’t hesitate to reach out for help! Consulting with a financial advisor who understands halal investing can be a game-changer. They can guide you through the process, help you understand your options, and make sure you’re on the right track. It’s like having a coach in your corner, cheering you on and giving you tips to succeed.

The Role of Zakat in Halal Investments

Calculating Zakat on Investments

When you think about your investments, don’t forget about zakat! This is a key part of being a responsible investor in Islam. Zakat is like a yearly check-up for your wealth, where you give away 2.5% of your eligible assets to help those in need. It’s not just about cash; you also need to consider the value of your investments. For stocks, you should look at the company’s assets, like cash and inventory, to figure out how much zakat you owe. It can be a bit tricky, but it’s super important to get it right.

Incorporating Zakat into Financial Planning

Including zakat in your financial plans is a smart move. It helps you keep track of your wealth and ensures you’re giving back to the community. Think of it as a way to stay grounded and connected to your values while you grow your money. Plus, it feels good to know you’re making a positive impact with your wealth.

Community Impact of Zakat

Zakat isn’t just about numbers; it’s about people. When you pay zakat, you’re helping to lift others up. This creates a ripple effect in your community, promoting social justice and support for those who need it most. So, every time you calculate your zakat, remember that you’re not just fulfilling a religious duty; you’re also contributing to a better world.

Common Pitfalls in Halal Investing

Misinterpretation of Shariah Guidelines

When diving into halal investing, it’s super important to really understand what’s halal and what’s not. Many folks think they’re making good choices, but they might be misreading the rules. For example, some might invest in companies that seem okay but actually deal in haram activities. Always double-check the guidelines and maybe even consult someone knowledgeable to avoid these traps.

Overlooking Hidden Haram Elements

Sometimes, investments can look halal on the surface but have hidden haram elements. This could be anything from a company’s side business to the way they handle their finances. It’s like peeling an onion; you have to dig deeper to see what’s really going on. Ask questions and do your homework to ensure your investments align with your values.

Ignoring Market Volatility

Investing always comes with risks, and halal investing is no different. Some people jump into investments without considering how the market can change. It’s crucial to keep an eye on market trends and be ready for ups and downs. A little research can go a long way in helping you make informed decisions and avoid panic selling when things get tough.

Halal Investment Funds and ETFs

Popular Halal Funds to Consider

When it comes to halal investment funds, you have some great options to explore. These funds are designed to help you invest in a way that aligns with your values. Think of them as a way to grow your money while sticking to Islamic principles. You can find funds that focus on stocks, real estate, and even sukuk, which are Islamic bonds. Just remember to check if they meet the Shariah guidelines before diving in.

Understanding Expense Ratios

Expense ratios are important to keep in mind when choosing a fund. This is basically the fee you pay for the fund’s management. Lower expense ratios mean more of your money stays invested, which is always a good thing. So, when you’re looking at different halal funds, compare these ratios to make sure you’re getting the best deal.

The Importance of Regular Reevaluation

Investing isn’t a set-it-and-forget-it kind of deal. You need to keep an eye on your investments and reevaluate them regularly. This means checking if your halal funds are still compliant with Shariah law and if they’re performing well. It’s like giving your investment portfolio a little tune-up every now and then to make sure everything is running smoothly.

The Future of Halal Investing

Emerging Trends and Opportunities

As we look ahead, halal investing is becoming more popular, and it’s not just for Muslims anymore. People from all backgrounds are seeing the value in investing ethically. You might notice that more companies are focusing on sustainable finance Islamic principles. This means they’re not just about making money; they care about doing good for the world too. Imagine investing in businesses that help the environment or support local communities. That’s the kind of future we’re heading towards!

Technological Advancements in Investment

With the rise of Islamic fintech, investing is getting easier and more accessible. You can now find apps and platforms that help you invest in halal options without the hassle. These tools make it simple to check if a company is Shariah-compliant. Plus, they often provide insights and tips to help you make smart choices. It’s like having a financial buddy right in your pocket!

The Growing Global Market for Halal Investments

The market for halal investments is expanding rapidly. More people are recognizing the importance of ethical investing, and this trend is only going to grow. As more investors join in, you’ll find a wider variety of halal options available. This means you can build a diverse portfolio that aligns with your values while still aiming for good returns. It’s an exciting time to be part of this movement!

Comparing Halal and Conventional Investment Strategies

Risk Management Approaches

When you think about investing, you might picture a world of numbers and charts. But there’s more to it than that! In halal investing, you focus on avoiding risky ventures that don’t align with Islamic principles. This means steering clear of investments that involve excessive uncertainty or speculation. On the other hand, conventional investing often embraces higher risks in hopes of bigger rewards. It’s like choosing between a steady, reliable path and a wild rollercoaster ride!

Return on Investment Expectations

Now, let’s talk about returns. In halal investing, you’re looking for profits that come from ethical sources. This means your returns should come from businesses that are doing good in the world. Conventional investing, however, might not always consider the ethics behind the profits. Sometimes, it’s all about the numbers, and that can lead to some questionable choices. So, while both strategies aim for profit, halal investing does it with a conscience.

Cultural and Ethical Differences

Finally, let’s not forget the cultural side of things. Halal investing is deeply rooted in Islamic values, which guide your choices and help you feel good about where your money goes. Conventional investing, however, is more about maximizing profits, regardless of the impact on society. It’s like choosing between a meal that’s not only tasty but also good for you versus one that’s just fast food. Both can fill you up, but one leaves you feeling better in the long run.

The Impact of Global Events on Halal Investments

Economic Shifts and Market Dynamics

When you think about investing, it’s not just about picking the right stocks or funds. Global events can shake things up in ways you might not expect. For instance, when economies change, it can affect the value of your investments. If a country faces a recession, companies might struggle, and that could impact your halal investments. Keeping an eye on economic news can help you make smarter choices.

Geopolitical Influences

Geopolitical events, like conflicts or trade agreements, can also play a big role. Imagine a country you’ve invested in suddenly facing political unrest. That could lead to a drop in stock prices or even halt business operations. It’s important to stay informed about global politics because it can directly affect your investment portfolio.

Adapting to Climate Change

Lastly, climate change is becoming a hot topic in investing. Companies that don’t adapt to environmental changes might face backlash or even legal issues. As a halal investor, you want to support businesses that are sustainable and responsible. So, looking for companies that prioritize eco-friendly practices can not only align with your values but also protect your investments in the long run.

Conclusion

In summary, halal investing is a way to grow your money while staying true to Islamic values. It encourages people to put their money into businesses that are ethical and avoid those that go against their beliefs. Although finding the perfect halal investment can be tough, there are many options available today. By learning the rules and carefully checking each investment, anyone can find ways to invest that fit their values. Ultimately, how you choose to invest should reflect your personal beliefs and goals. With the right knowledge and support, halal investing can help you build a secure financial future.